The siren song of cryptocurrency mining continues to beckon, drawing in entrepreneurs and tech enthusiasts alike. In the United States, the debate isn’t just *whether* to mine, but *how*. Two primary models dominate the landscape: cloud mining and physical machine hosting. Each offers a unique set of advantages and disadvantages, painting a complex picture for prospective miners.

Cloud mining, in essence, is renting computational power. You lease hash rate from a provider who owns and maintains the mining hardware. This eliminates the upfront investment in expensive equipment and the hassles of managing it. Imagine accessing the potential of Bitcoin mining without ever touching a physical mining rig. Sounds idyllic, right? However, this ease of entry comes at a price. Cloud mining contracts often lack transparency. Determining the true cost of electricity and maintenance, which directly impacts profitability, can be difficult. Scam operations, unfortunately, are also prevalent in this space. Due diligence is paramount; research, verify, and proceed with extreme caution before entrusting your capital to any cloud mining service.

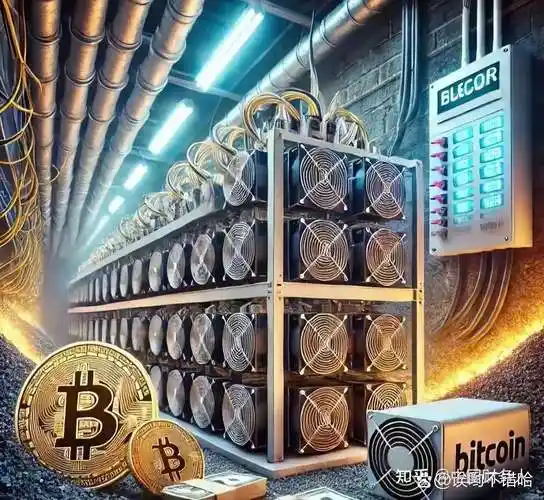

Physical machine hosting, on the other hand, offers tangible control. You purchase your own Application-Specific Integrated Circuit (ASIC) miners – specialized machines designed for cryptocurrency mining – and then pay a hosting facility to house and maintain them. This offers greater transparency; you understand your energy costs, have physical ownership of your assets, and can exert more control over your mining operations. Think of it as owning a piece of the digital gold rush, complete with its own pickaxe. However, this route demands significant upfront capital. High-performance mining rigs can cost thousands of dollars. Finding a reliable hosting facility with competitive electricity rates and robust security is also crucial. Furthermore, the technical expertise to troubleshoot hardware issues and optimize performance becomes essential.

The allure of Bitcoin (BTC) mining is undeniable. Its established market presence and scarcity attract investors globally. Both cloud mining and physical machine hosting offer pathways to acquiring BTC, albeit with vastly different risk profiles. Ethereum (ETH), while shifting away from Proof-of-Work (PoW) to Proof-of-Stake (PoS), once fueled a significant mining ecosystem, primarily through GPUs (Graphics Processing Units). While ETH mining is now largely obsolete, the infrastructure and knowledge gained still ripple through the cryptocurrency space, influencing alternative PoW coin mining strategies. Even Dogecoin (DOGE), born as a meme, benefits from its PoW consensus mechanism, creating a niche market for miners seeking alternative avenues for profitability.

Consider the energy requirements. Mining, particularly Bitcoin mining, is notoriously energy-intensive. Regions with cheap electricity, like certain parts of the United States, become hotspots for mining operations. Hosting facilities often negotiate bulk electricity rates, passing some of the savings onto their clients. But even with discounted rates, electricity costs can significantly impact profitability. Understanding these costs is crucial to making informed decisions.

The cryptocurrency exchange plays a vital role in converting mined coins into usable currency. Choosing a reputable exchange with low fees and high liquidity is essential for maximizing returns. Popular exchanges like Coinbase, Binance, and Kraken offer various trading pairs and services, allowing miners to efficiently convert their holdings into fiat currency or other cryptocurrencies.

Volatility reigns supreme in the cryptocurrency market. The value of Bitcoin, Ethereum, and other cryptocurrencies can fluctuate dramatically, impacting the profitability of mining operations. A sudden price drop can render even the most efficient mining setups unprofitable. Risk management is therefore critical. Diversifying mining activities, hedging against price fluctuations, and carefully monitoring market trends are all essential strategies for navigating the volatile crypto landscape.

Ultimately, the choice between cloud mining and physical machine hosting hinges on individual circumstances, risk tolerance, and technical expertise. Cloud mining offers a lower barrier to entry but demands meticulous due diligence. Physical machine hosting provides greater control and transparency but requires significant upfront investment and technical knowledge. As the cryptocurrency landscape continues to evolve, informed decision-making and a thorough understanding of the underlying technologies are paramount to success in the challenging yet potentially rewarding world of cryptocurrency mining.

Leave a Reply