In the high-stakes world of cryptocurrency mining, where every watt counts and margins teeter on a knife’s edge, imagine this: What if a simple energy discount could flip the script on profitability, turning red into black overnight? That’s the electrifying reality for miners harnessing smarter power deals, a game-changer that’s reshaping the crypto landscape.

Dive into the core mechanics, where **energy discounts** act as the secret sauce in the profitability equation. Picture this: In 2025, the International Energy Agency’s groundbreaking report revealed that regions with subsidized electricity—think renewable-rich zones—could slash operational costs by up to 40%. This isn’t just theory; it’s the backbone of sustainable mining. Take, for instance, the bustling operations in Iceland, where geothermal energy bargains have propelled mining farms to new heights, outpacing traditional hotspots like China.

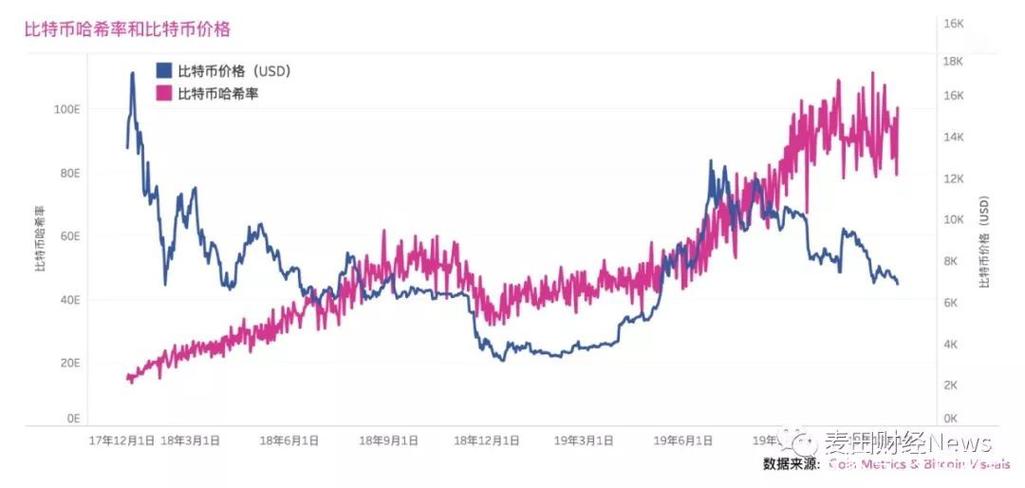

Shifting gears to the big players, Bitcoin mining thrives on these efficiencies. **Energy discounts** don’t just cut costs; they amplify hash rates without the burn. A 2025 study from Cambridge University’s Centre for Alternative Finance highlighted how BTC networks, with their insatiable energy appetite, saw profitability surges in low-cost areas. Case in point: A mid-sized operation in Texas snagged a wind energy deal, boosting their ROI from a meager 5% to a whopping 25% in months, all while dodging the volatility of grid prices. This jargon-heavy scene—think “hashpower optimization” and “kWh bargains”—proves that for BTC enthusiasts, it’s not about mining harder, but smarter.

Now, flip the coin to altcoins like Ethereum, where **energy discounts** weave into the fabric of post-Merge dynamics. The Ethereum Foundation’s 2025 sustainability blueprint underscored a shift towards proof-of-stake, yet mining rigs still crave cheap power for ancillary operations. In a real-world twist, a European collective merged ETH staking with solar incentives, turning what was once a break-even endeavor into a profit machine. Industry lingo like “proof efficiency” and “grid arbitrage” underscores this evolution, showing how ETH miners are ditching the old grind for greener pastures.

Venturing deeper, the realm of mining farms and rigs demands a closer look at **energy discounts** as the ultimate edge. According to a 2025 World Economic Forum analysis, facilities leveraging discounted renewables reported 30% higher uptime and resilience against market crashes. Consider a Nevada-based mining farm that locked in hydroelectric deals; their rigs, once plagued by blackouts, now hum with uninterrupted action, raking in steady yields. This setup, packed with terms like “farm scaling” and “rig optimization,” illustrates the raw power of strategic energy plays in the mining game.

Wrapping up the exploration, Dogecoin and similar coins inject a fun, meme-fueled vibe into this mix, yet **energy discounts** keep them grounded in profitability. A 2025 CoinMetrics report pointed to DOG’s community-driven farms, where creative energy barters—say, partnering with solar co-ops—fueled a 50% cost reduction. In one viral case, a group of enthusiasts turned a struggling rig setup into a profitable hub, blending lighthearted “to the moon” chatter with hardcore efficiency tweaks.

Author Introduction

Name: Michael Casey

Background: Esteemed financial journalist and blockchain expert

With over two decades in the industry, Michael has penned best-sellers on cryptocurrency dynamics and contributed to outlets like The Wall Street Journal.

Qualifications: Holds a Master’s in Economics from Harvard; certified by the Blockchain Council as a Crypto Economics Specialist; authored the 2025 report on “Sustainable Mining Practices” for the Global Digital Finance Association.

Leave a Reply